In Service Rollover Roth 401k

There is no direct way to undertake a 401K rollover to Roth IRA. Who is eligible to do an in-plan Roth rollover.

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

An in-service distribution allows you to rollover your vested balance from your profit sharing plan to an IRA.

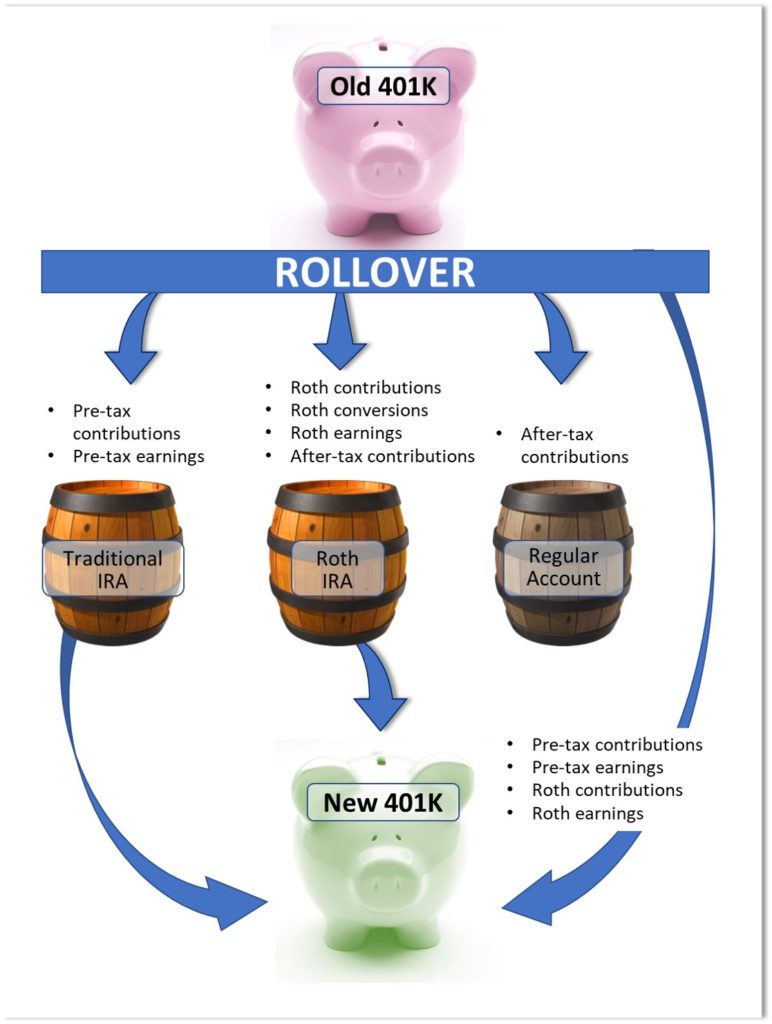

In service rollover roth 401k. A traditional 401 k is funded with pre-tax dollars and taxed upon withdrawal. But the advantage is that you do not have to pay any tax while rolling over to a traditional IRA and once you withdraw money from Roth IRA you wont need to pay. If you elect to do this the assets can be transferred in a trustee-to-trustee transfer also known as a direct rollover to avoid mandatory income tax withholdings on the earnings.

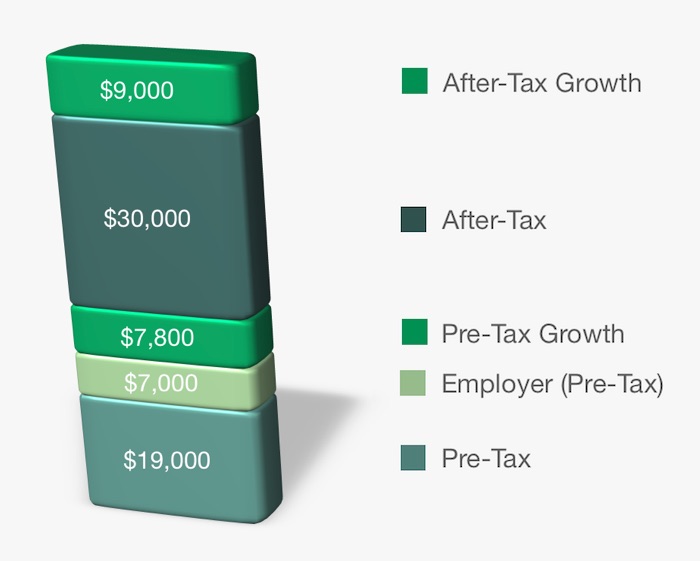

Reasons to Do a 401k In-Service Distribution. It is important to complete the rollover in a timely manner so that you can avoid 401k taxes and 401k withdrawal penalties for an early withdrawal. I have a question about the tax consequence of in-service rollover of after-tax contributions and the associated pre-tax earnings from my 401k sub-account to my personal Vanguard Roth IRA account.

Turn your pre-tax 401 k into a Roth 401 k. While in-service distributions are available from a wide variety of qualified retirement plans rules on the availability of such withdrawals may vary by the type of plan and the type of contribution eg employee deferrals rollovers employer contributions etc. What is the Roth 401 k rollover 5-year rule.

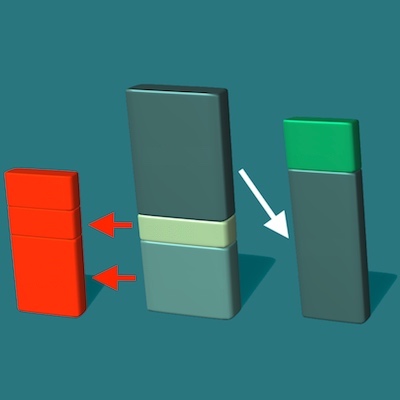

Completing the Roth 401k Rollover Process. Employee after-tax not Roth contributions. By doing a 401k in-service withdrawal you will be taxed.

However some employers do permit an in-service rollover where you can do the rollover while still employed. When it comes to rolling over money from a 401k plan while still working for the employer the law allows rolling over. The deadline is not flexible and you may want to choose where you want to open your IRA before you begin the process of cashing out your 401k.

You have to pay taxes while doing a rollover to a Roth IRA. Pete isnt eligible to take a distribution from his Roth deferral account since hes only age 45 and hasnt. At the end of 2017 I requested the after-tax contributions 9852 and the associated pre-tax earnings 407 to be rolled over to my Vanguard Roth IRA account.

Just ask them if they have an inservice rollover. In order for you to have a clear understanding of this rule it is important to clear up some differences between a traditional 401 k and the Roth 401 k. Yes this is a simple explanation but its just to.

Some plans may restrict from doing so. As a reminder you must generally be separated from your employer to roll your 401k into a Roth IRA. The best way to accomplish a rollover to either a Roth IRA or another Roth 401 k is from trustee to trustee.

Employee pre-tax and Roth contributions only if the employee reaches age 59-12. You will have to determine first if you are eligible. Here are some reasons that.

I contributed after tax dollars to my retirement account in 2017. An employee who is at least 59 years old will avoid the 10 penalty on the money moved and will not be immediately required to pay the deferred taxes on the money. Benefits of an In-Service Rollover.

Before the end of 2010 Pete requests an in-service distribution of the maximum amount possible from his designated Roth account. Be sure to rollover the money to an IRA if you dont need it. For example in-service rules that apply to qualified plans do not apply to employer-sponsored IRA plans such as SEP SAR SEP.

It used to be that just a handful of employees could make this bold. In some instances you may be able to do a rollover of funds from a 401k at your current employer through whats called an In-Service Distribution Unfortunately most large employers are highly restrictive and make this nearly impossible. As expected I received a single check payable to my Roth.

The only source available from his designated Roth account is the total account balance of the IRR source which has been separately accounted for. You are permitted to toll over your Roth 401 k plan assets into a Roth IRA. 401k 403b and 457b governmental plans that have designated Roth accounts may offer in-plan Roth rollovers.

Its done via an in-plan Roth conversion also known as an in-plan Roth rollover. A Roth 401 k is funded with post-tax dollars and not taxed upon withdrawal. Roth IRA Rollover Rules From 401k.

An in-service rollover allows a current employee to move all or some of the assets in their employer-sponsored 401 k plan into an IRA without taking the money as a distribution. In fact the guidance under IRS Notice 2010-84 explicitly states in QA-7 that the taxable amount of an in-plan Roth rollover is the amount that would be includible in a participants gross income if the rollover were made to a Roth IRA Which means again that the pro-rata rule will apply here to an intra-plan Roth conversion too. Its permitted by the IRS but not all employers participate.

Participants surviving spouse beneficiaries and alternate payees who are current or former spouses are eligible to do an in-plan Roth rollover in a plan offering these rollovers. The reason behind this is that a Roth IRA is typically used for after-tax money post retirement savings. This ensures a seamless transaction that should not be challenged later by the IRS.

Roll Over 401k To Ira When Changing Jobs Changing Jobs Financial Advice Roth Ira

Irs Chart Of Rollover Options How To Plan B Plan 401k Plan

Rollover Revisited Why Sticking With A 401k May Be Better

Important Wealth Changing Decision For Your 401k Retirement Account Investing Tips Ideas Investing Strategy Debt Solutions Investing

The Complete Guide To Rolling Over Your Old 401k To An Ira 401k Rollover 401k Rollover Ira

401k Plan Consultants Grand Rapids Mi Integrated Financial Services

High Earners To Roth 401 K Or Not Greenleaf Trust

More Money In Your 401k With This Decision Roth Vs Traditional 401k Vs Ira Investing Tips Personal Financial Planning Investing Investing Strategy

After Tax 401 K Contributions Retirement Benefits Fidelity

Do I Have To Pay Taxes If I Rollover My 401k To A Roth Ira Our Deer Paying Taxes Roth Ira Ira

The Pros And Cons Of A Roth 401k

How To Rollover Your 401k To A Roth Ira Can You Transfer It

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

401k Plan Consultants Grand Rapids Mi Integrated Financial Services

Post a Comment for "In Service Rollover Roth 401k"